Sports

3 High Insider Ownership ASX Growth Companies With Up To 37% Return On Equity

Amidst a broad downturn in the ASX200, with sectors ranging from Materials to Information Technology experiencing declines, investors are navigating a challenging market landscape. In such conditions, stocks with high insider ownership can be particularly appealing as they often indicate that company leaders have significant skin in the game, aligning their interests closely with shareholders even during turbulent times.

Top 10 Growth Companies With High Insider Ownership In Australia

|

Name |

Insider Ownership |

Earnings Growth |

|

Cettire (ASX:CTT) |

28.7% |

26.7% |

|

Telix Pharmaceuticals (ASX:TLX) |

16.1% |

38.1% |

|

Clinuvel Pharmaceuticals (ASX:CUV) |

13.6% |

26.8% |

|

Acrux (ASX:ACR) |

14.6% |

115.3% |

|

Catalyst Metals (ASX:CYL) |

17% |

75.7% |

|

Biome Australia (ASX:BIO) |

34.5% |

114.4% |

|

Hillgrove Resources (ASX:HGO) |

10.4% |

49.4% |

|

Ora Banda Mining (ASX:OBM) |

10.2% |

106.8% |

|

Plenti Group (ASX:PLT) |

12.8% |

106.4% |

|

Change Financial (ASX:CCA) |

26.6% |

77.9% |

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★★★

Overview: Catalyst Metals Limited is an Australian company focused on the exploration and evaluation of mineral properties, with a market capitalization of approximately A$450.44 million.

Operations: The company generates revenue primarily from its operations in Tasmania, totaling approximately A$57.87 million.

Insider Ownership: 17%

Return On Equity Forecast: 38% (2026 estimate)

Catalyst Metals, an Australian growth company with high insider ownership, has recently reported a 41% increase in gold production at its Plutonic site and announced a maiden Ore Reserve Estimate for the Trident Deposit. These developments are part of a broader strategy that includes lowering capital costs and leveraging existing infrastructure to enhance operational efficiencies. Despite challenges such as short cash runways and shareholder dilution over the past year, Catalyst’s revenue is expected to grow by 40.4% annually, outpacing the market significantly. The company is also trading at substantial value relative to peers, with profitability anticipated within three years.

Simply Wall St Growth Rating: ★★★★★☆

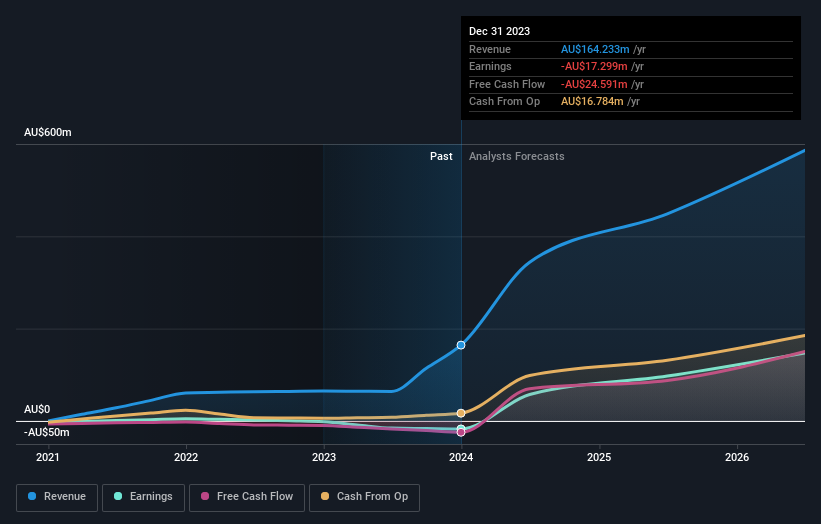

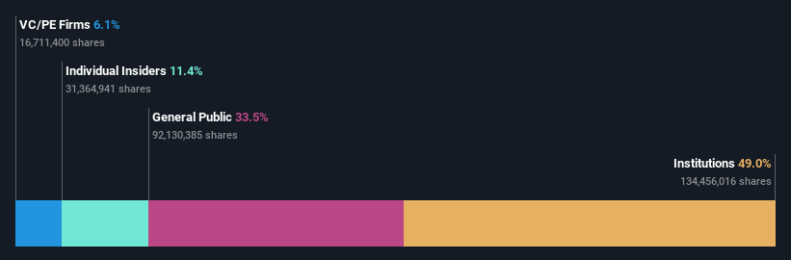

Overview: SiteMinder Limited, an Australian company, develops and markets an online guest acquisition platform and commerce solutions for accommodation providers globally, with a market capitalization of approximately A$1.51 billion.

Operations: The company generates A$171.70 million from its software and programming segment.

Insider Ownership: 11.3%

Return On Equity Forecast: 24% (2026 estimate)

SiteMinder, an Australian growth company with significant insider ownership, is poised for robust expansion with earnings expected to grow 74.41% annually. The firm’s strategic partnership with Cloudbeds, aimed at enhancing platform connectivity and operational accuracy for hoteliers, underscores its commitment to revenue growth and market expansion. Despite trading 40.8% below its estimated fair value, SiteMinder shows promising prospects with forecasted high Return on Equity of 24.2% in three years and revenue growth projected at 19.1% per year, surpassing the Australian market average.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is an Australian company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both domestically and internationally, with a market capitalization of approximately A$6.38 billion.

Operations: The company generates revenue through three primary segments: software sales contributing A$317.24 million, corporate services at A$83.83 million, and consulting services amounting to A$68.13 million.

Insider Ownership: 12.3%

Return On Equity Forecast: 33% (2027 estimate)

Technology One, an Australian software company, is demonstrating solid growth with earnings up by 13.1% over the past year and forecasts indicating a 14.35% annual increase. Its revenue growth at 11.1% per year surpasses the national average of 5.2%. The recent appointment of Paul Robson as Non-Executive Director could further enhance strategic transformations and operational efficiencies in its SaaS offerings. Despite a high P/E ratio of 58.3x, it remains below the industry average, suggesting potential value for investors focused on growth companies with substantial insider involvement.

Make It Happen

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:CYL ASX:SDR and ASX:TNE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com