Sports

3 US Growth Stocks With High Insider Ownership

As economic concerns ease and tech stocks rally, major U.S. stock indexes have seen significant gains, with the S&P 500 and Nasdaq Composite up 1.8% and 2.3%, respectively. In this favorable market environment, identifying growth companies with high insider ownership can be particularly rewarding as it often signals confidence from those closest to the business’s operations and prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

|

Name |

Insider Ownership |

Earnings Growth |

|

Atour Lifestyle Holdings (NasdaqGS:ATAT) |

26% |

21.7% |

|

PDD Holdings (NasdaqGS:PDD) |

32.1% |

22.1% |

|

GigaCloud Technology (NasdaqGM:GCT) |

25.7% |

25.4% |

|

Victory Capital Holdings (NasdaqGS:VCTR) |

12% |

34% |

|

Hims & Hers Health (NYSE:HIMS) |

13.8% |

40.5% |

|

Super Micro Computer (NasdaqGS:SMCI) |

14.3% |

31.8% |

|

Credo Technology Group Holding (NasdaqGS:CRDO) |

14.4% |

60.9% |

|

EHang Holdings (NasdaqGM:EH) |

32.8% |

74.3% |

|

Carlyle Group (NasdaqGS:CG) |

29.2% |

21.3% |

|

BBB Foods (NYSE:TBBB) |

22.9% |

70.7% |

Let’s take a closer look at a couple of our picks from the screened companies.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ameresco, Inc. is a clean technology integrator offering energy efficiency and renewable energy solutions across the United States, Canada, Europe, and internationally with a market cap of $1.51 billion.

Operations: The company’s revenue segments include energy efficiency solutions and renewable energy supply offerings across various regions, including the United States, Canada, Europe, and international markets.

Insider Ownership: 38.2%

Ameresco, a growth company with high insider ownership, is forecasted to achieve significant annual earnings growth of 28% over the next three years, surpassing the US market average. Despite recent volatility and lower-than-expected Q2 net income ($5.01 million), Ameresco’s strategic initiatives like battery energy storage systems and a $1.70 billion to $1.80 billion revenue guidance for 2024 highlight its robust expansion plans. However, challenges include interest payments not well covered by earnings and a lower forecasted Return on Equity (13.1%).

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RingCentral, Inc., with a market cap of approximately $3.11 billion, offers cloud communications, video meetings, collaboration, and contact center software-as-a-service solutions globally.

Operations: RingCentral generates $2.31 billion in revenue from its Internet Software & Services segment.

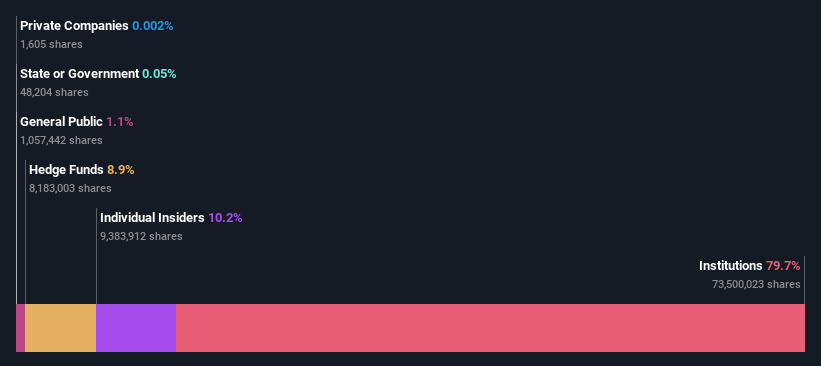

Insider Ownership: 10.4%

RingCentral, with high insider ownership, is forecast to achieve 78.38% annual earnings growth and become profitable within three years, outperforming the market. Despite a net loss of US$14.75 million in Q2 2024, revenue rose to US$592.91 million from US$539.31 million last year. Recent expansions with Vodafone Business and Avaya enhance its strategic positioning in cloud communications, supporting hybrid work models globally and driving future revenue growth despite slower-than-market projections (7.2% annually).

Simply Wall St Growth Rating: ★★★★☆☆

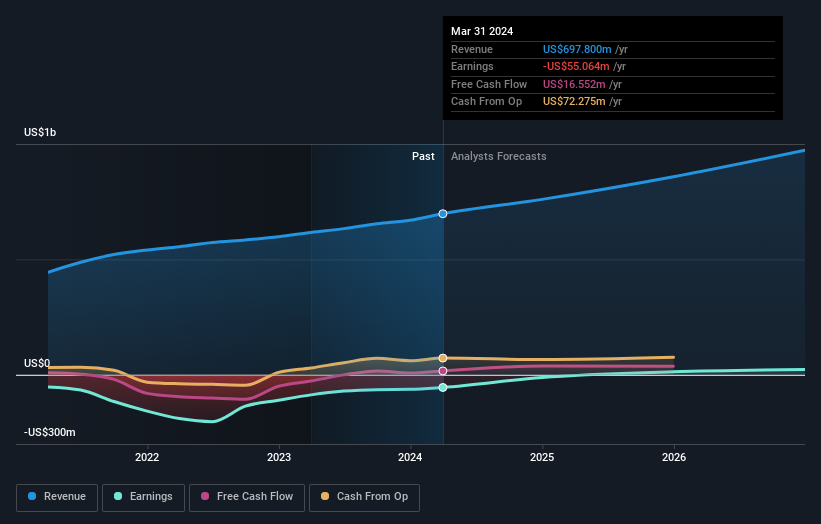

Overview: Warby Parker Inc. offers eyewear products in the United States and Canada, with a market cap of approximately $1.76 billion (NYSE:WRBY).

Operations: Warby Parker generates revenue from its medical optical supplies segment, which amounts to $697.80 million.

Insider Ownership: 20%

Warby Parker, a growth company with high insider ownership, has shown significant revenue increases and reduced losses. For Q2 2024, sales were US$188.22 million, up from US$166.09 million last year, while net loss narrowed to US$6.76 million from US$15.93 million. The company forecasts full-year 2024 revenue between US$757 million and US$762 million, reflecting growth of approximately 13% to 14%. Recent board appointments further strengthen its leadership team as it aims for profitability within three years.

Summing It All Up

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NYSE:AMRC NYSE:RNG and NYSE:WRBY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com