Sports

LondonMetric Property PLC’s Dividend Analysis

Exploring the Sustainability and Growth Prospects of LondonMetric Property PLC’s Dividends

LondonMetric Property PLC (LNSPF) recently announced a dividend of $0.03 per share, payable on 2024-07-22, with the ex-dividend date set for 2024-06-13. As investors look forward to this upcoming payment, the spotlight also shines on the company’s dividend history, yield, and growth rates. Using the data from GuruFocus, let’s look into LondonMetric Property PLC’s dividend performance and assess its sustainability.

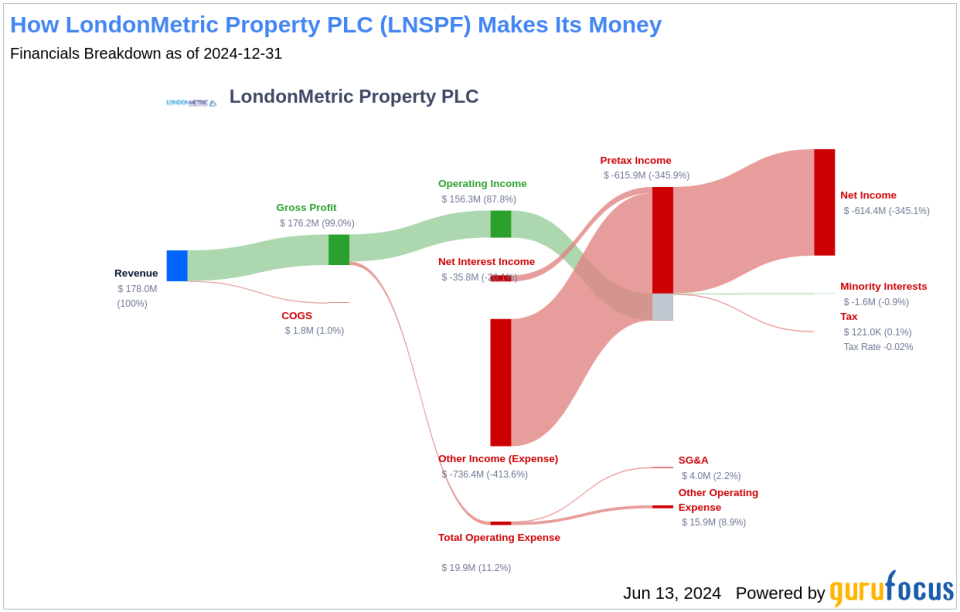

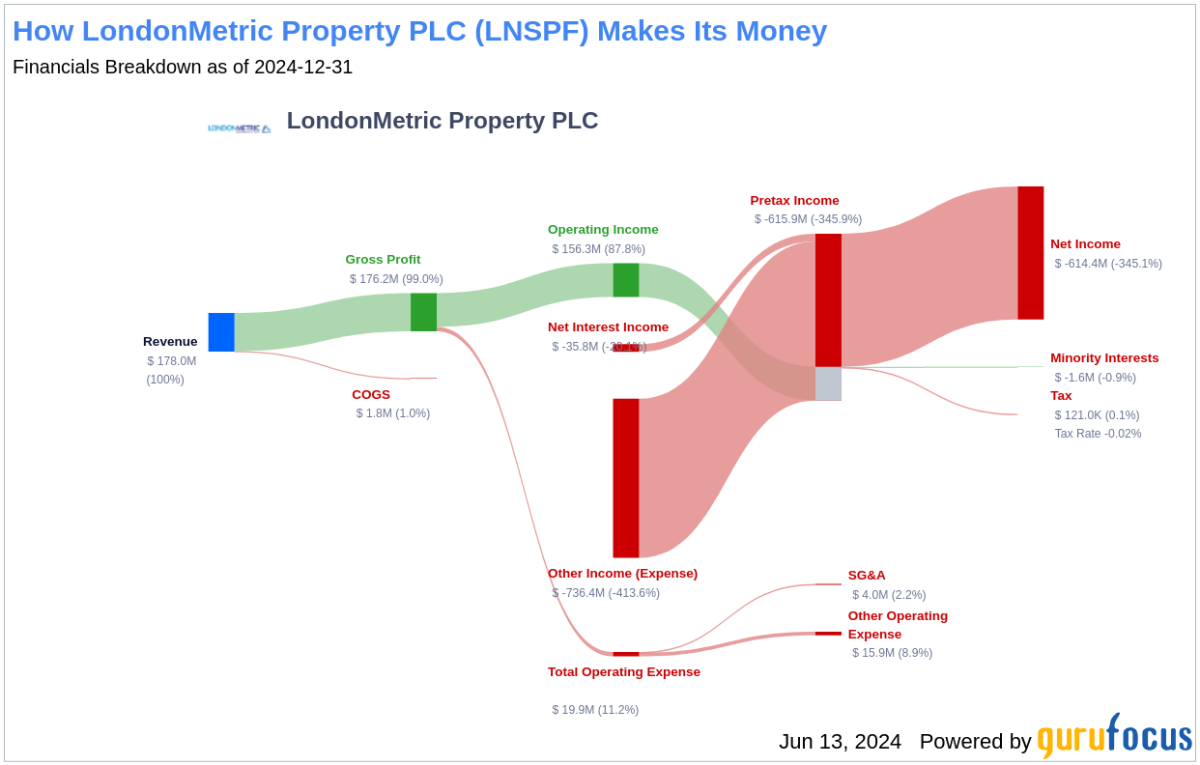

What Does LondonMetric Property PLC Do?

LondonMetric Property PLC is a real estate company that is engaged in property investment and development across the United Kingdom. The company focuses on properties in the retail and distribution businesses. The company categorizes its property portfolios in six segments: Distribution, retail parks, Long income, Office, Residential, and Development. The company generates its revenue mainly from contracted leases.

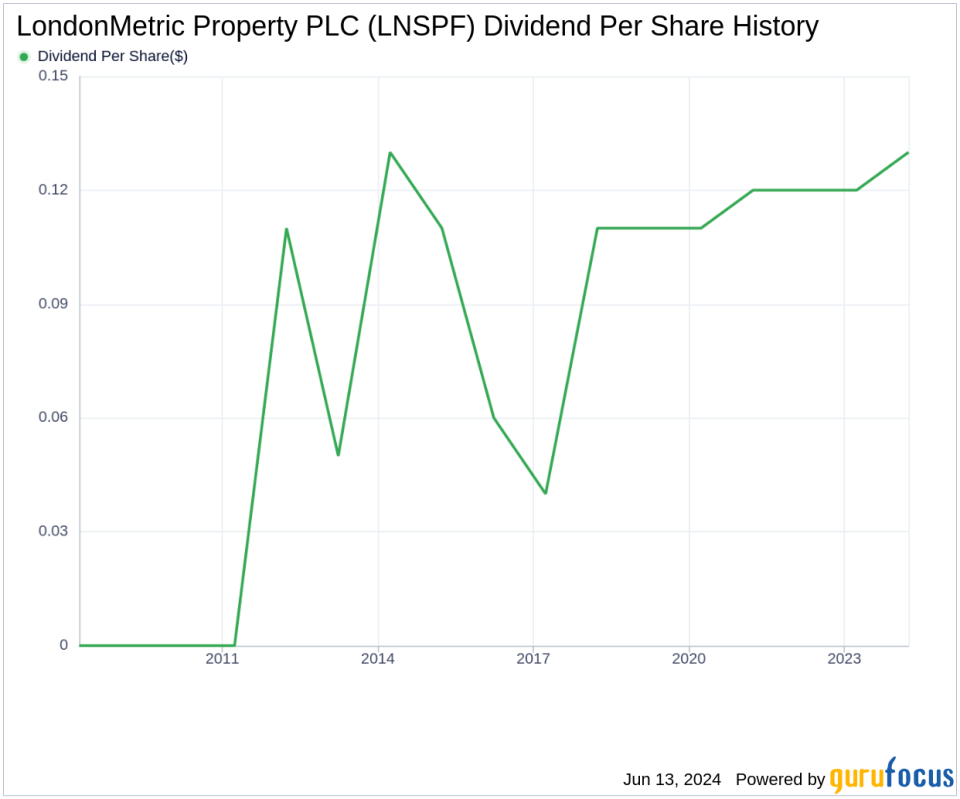

A Glimpse at LondonMetric Property PLC’s Dividend History

LondonMetric Property PLC has maintained a consistent dividend payment record since 2011. Dividends are currently distributed on a quarterly basis. Below is a chart showing annual Dividends Per Share for tracking historical trends.

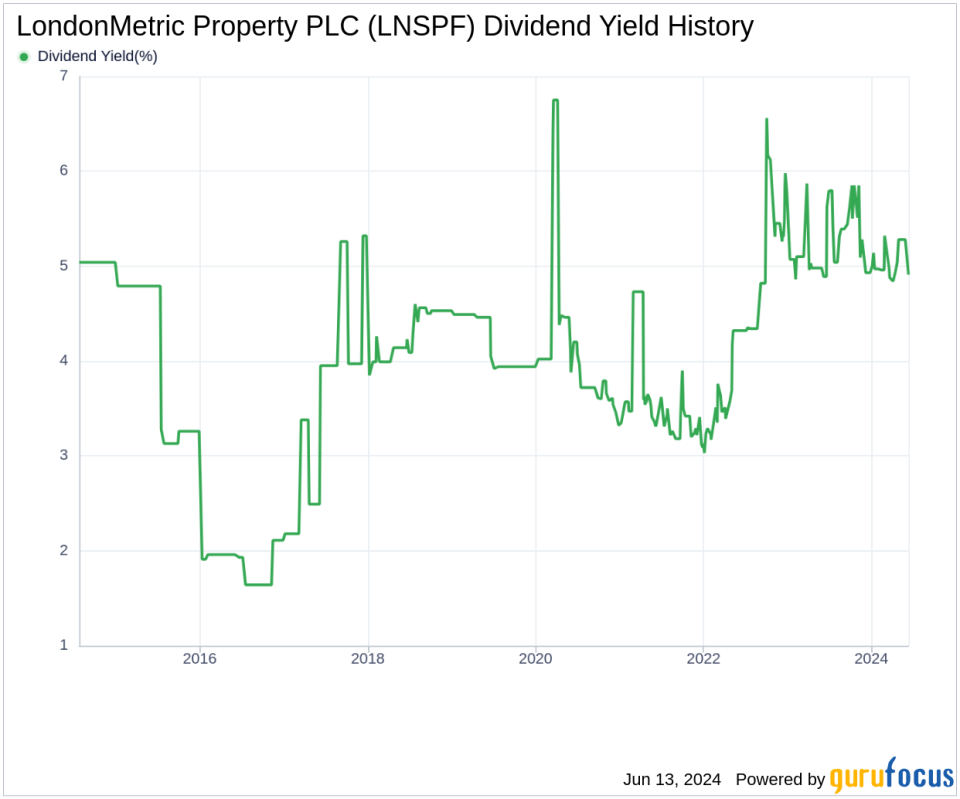

Breaking Down LondonMetric Property PLC’s Dividend Yield and Growth

As of today, LondonMetric Property PLC currently has a 12-month trailing dividend yield of 4.92% and a 12-month forward dividend yield of 5.11%. This suggests an expectation of increased dividend payments over the next 12 months.

Over the past three years, LondonMetric Property PLC’s annual dividend growth rate was 4.50%. Extended to a five-year horizon, this rate decreased to 4.00% per year. And over the past decade, LondonMetric Property PLC’s annual dividends per share growth rate stands at 3.20%.

Based on LondonMetric Property PLC’s dividend yield and five-year growth rate, the 5-year yield on cost of LondonMetric Property PLC stock as of today is approximately 5.99%.

The Sustainability Question: Payout Ratio and Profitability

To assess the sustainability of the dividend, one needs to evaluate the company’s payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2024-03-31, LondonMetric Property PLC’s dividend payout ratio is 0.90, which may suggest that the company’s dividend may not be sustainable.

LondonMetric Property PLC’s profitability rank, offers an understanding of the company’s earnings prowess relative to its peers. GuruFocus ranks LondonMetric Property PLC’s profitability 7 out of 10 as of 2024-03-31, suggesting good profitability prospects. The company has reported net profit in 8 years out of the past 10 years.

Growth Metrics: The Future Outlook

To ensure the sustainability of dividends, a company must have robust growth metrics. LondonMetric Property PLC’s growth rank of 7 out of 10 suggests that the company’s growth trajectory is good relative to its competitors.

Revenue is the lifeblood of any company, and LondonMetric Property PLC’s revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. LondonMetric Property PLC’s revenue has increased by approximately 5.60% per year on average, a rate that outperforms approximately 56.12% of global competitors.

The company’s 3-year EPS growth rate showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, LondonMetric Property PLC’s earnings increased by approximately 4.40% per year on average, a rate that outperforms approximately 46.67% of global competitors.

Lastly, the company’s 5-year EBITDA growth rate of 4.30%, which outperforms approximately 58.03% of global competitors.

Conclusion and Next Steps

In conclusion, while LondonMetric Property PLC’s dividend payments and growth rates are promising, investors should consider the sustainability concerns highlighted by the payout ratio. However, the company’s solid profitability and growth metrics provide a counterbalance, suggesting potential for continued dividend payments. For those interested in further analysis or similar investment opportunities, GuruFocus Premium users can explore using the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.