Sports

Warren Buffett Bolsters Holdings in Occidental Petroleum

Recent Acquisition Overview

On June 17, 2024, Berkshire Hathaway, under the stewardship of Warren Buffett (Trades, Portfolio), expanded its investment in Occidental Petroleum Corp (NYSE:OXY) by acquiring an additional 2,947,611 shares. This transaction, executed at a price of $59.7 per share, has increased Berkshire’s total holdings in OXY to 255,281,524 shares, marking a significant endorsement of the energy sector by the firm. This move not only reflects Buffett’s confidence in Occidental Petroleum but also impacts Berkshire Hathaway’s portfolio with a modest 0.05% trade impact, enhancing its position to a commanding 28.79% of the company’s shares.

Profile of Warren Buffett (Trades, Portfolio)

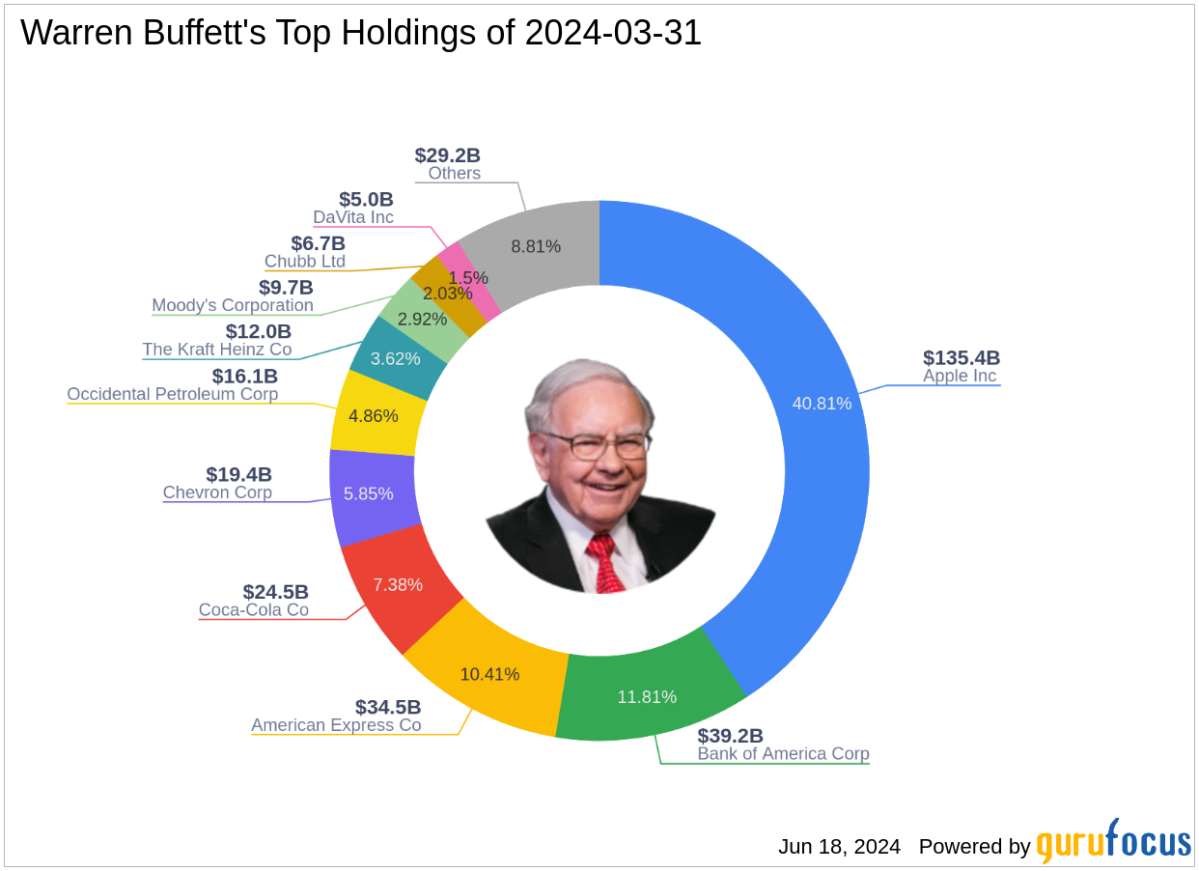

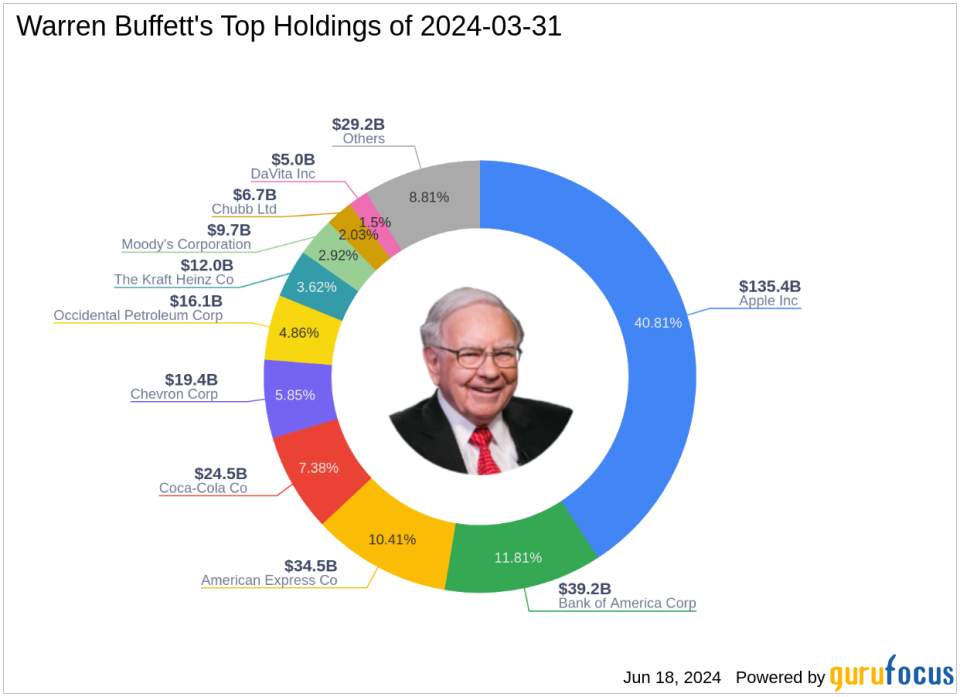

Warren Buffett (Trades, Portfolio), often referred to as “The Oracle of Omaha,” is a legendary figure in the investment world. As the Chairman of Berkshire Hathaway, Buffett has transformed a struggling textile mill into a colossal conglomerate, with a keen focus on insurance and other diverse investments. Buffett’s investment philosophy, deeply rooted in value investing principles taught by Benjamin Graham, emphasizes understanding a business deeply, investing with a margin of safety, and choosing companies with long-term potential. Berkshire Hathaway’s top holdings include giants like Apple Inc (NASDAQ:AAPL) and American Express Co (NYSE:AXP), showcasing a diversified approach primarily in technology and financial services sectors.

Insight into Occidental Petroleum Corp

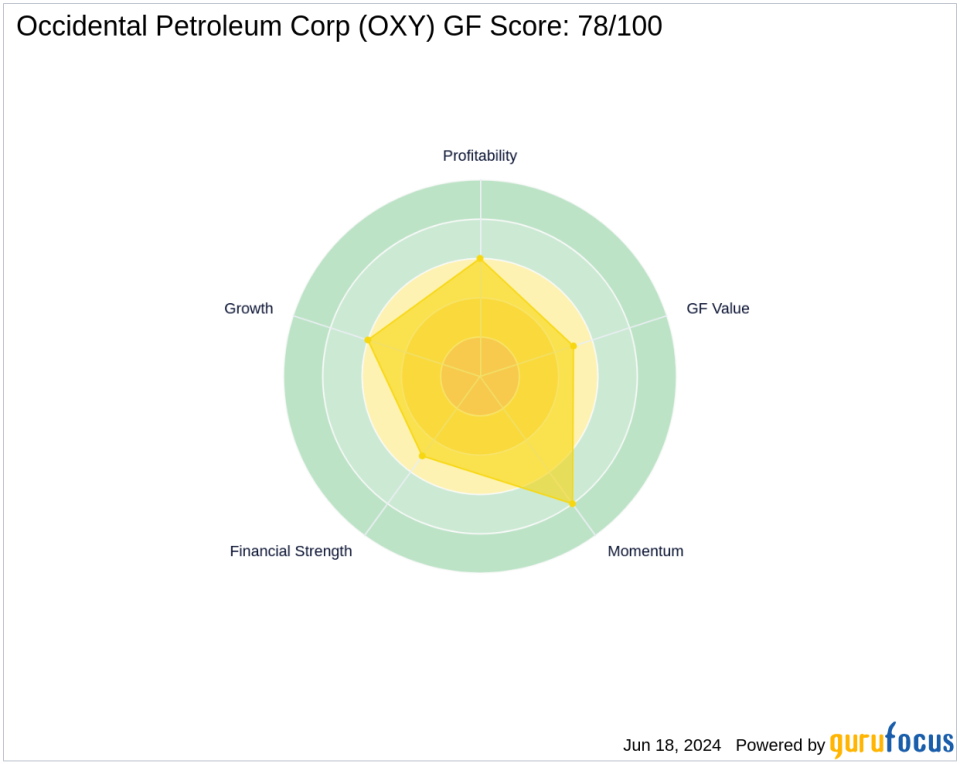

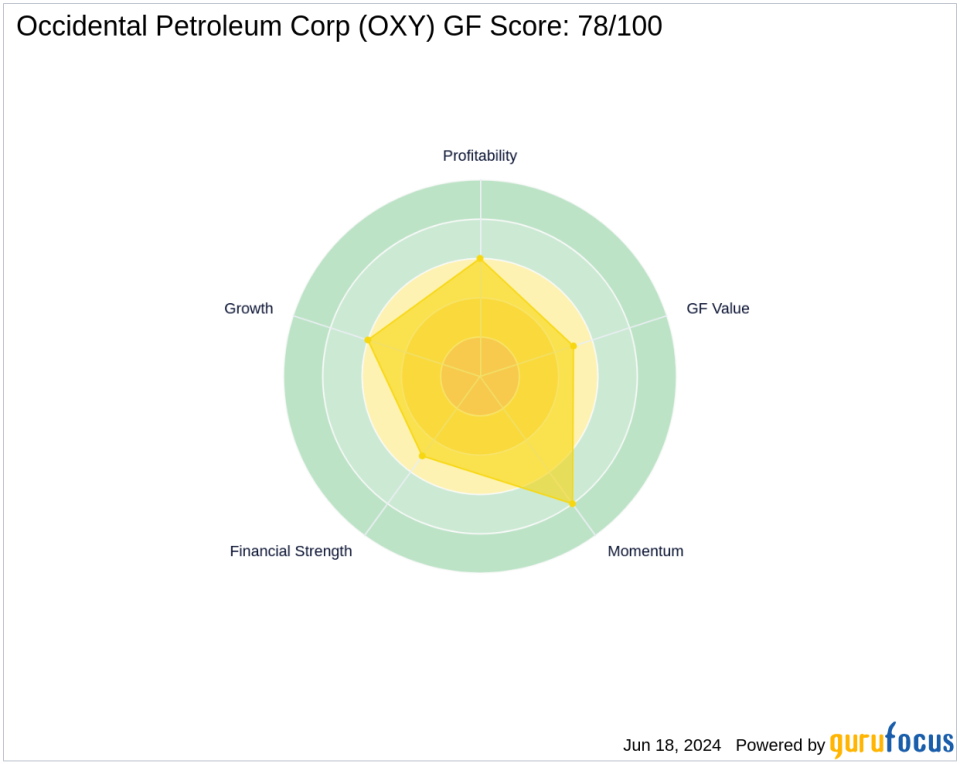

Occidental Petroleum is a leading entity in the oil and gas industry, focusing on exploration and production, with significant operations across the United States, Latin America, and the Middle East. As of the end of 2023, the company boasted nearly 4 billion barrels in net proved reserves, with a balanced production mix of oil and natural gas. With a market capitalization of $53.38 billion and a stock price of $60.2, Occidental is positioned as a substantial player in the energy sector. The company’s stock is currently deemed modestly overvalued with a GF Value of $53.76, reflecting a price to GF Value ratio of 1.12.

Portfolio Impact and Market Performance

Buffett’s recent investment in Occidental Petroleum significantly bolsters Berkshire Hathaway’s exposure to the energy sector, with OXY now constituting 4.59% of its total portfolio. This strategic move aligns with Berkshire’s history of betting on companies with robust long-term prospects. Occidental’s stock has shown a commendable performance with a year-to-date increase of 0.82% and a substantial gain of 945.14% since its IPO in 1986. The recent purchase price shows a slight gain of 0.84%, indicating positive immediate market reactions.

Comparative and Financial Analysis

Other notable investors like Dodge & Cox and Prem Watsa (Trades, Portfolio) also hold significant stakes in Occidental, although none as substantial as Berkshire Hathaway’s. Financially, Occidental maintains a Profitability Rank of 6/10 and a Growth Rank of 6/10, with a Piotroski F-Score of 5, indicating a stable financial footing. The company’s interest coverage ratio stands at 5.60, supporting its ability to manage debt.

Conclusion

Warren Buffett (Trades, Portfolio)’s increased stake in Occidental Petroleum underscores a strategic endorsement of the company’s long-term value and its alignment with Berkshire Hathaway’s investment philosophy. This move not only diversifies Berkshire’s vast portfolio but also highlights Buffett’s confidence in the energy sector’s growth prospects. As Occidental continues to navigate the dynamic energy market, this bolstered investment from one of the world’s most acclaimed investors could signal further positive trajectories for the company and its stakeholders.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.