Infra

Report on Public Electric Vehicle (EV) infrastructure in Scotland – Opportunities for Growth

Executive Summary

Drawing upon a period of engagement with the electric vehicle charging market (including with operators, technology providers, investors and others) this report:

- sets out context on the current landscape of electric vehicle charging in Scotland;

- draws out initial considerations for growing opportunities for investment in electric vehicle charging in line with the Scottish Government agenda for a just transition to net zero emissions; and

- highlights opportunities for greater private sector investment and involvement in the short to medium term through partnership approaches with local authorities.

Scottish Ministers have set ambitious climate targets, with a statutory requirement to achieve a 75% reduction in greenhouse gas emissions by 2030 and Net Zero by 2045. The transport sector is currently the greatest contributor to emissions with road transport responsible for the largest share. Supporting the uptake of electric vehicles is an important component of the Scottish Government’s Climate Change Plan and is aligned with the outcome of phasing out the need for new petrol and diesel cars and vans by 2030.

To facilitate the uptake of electric vehicles, the Scottish Government has implemented a wide number of interventions, including its investment in the ChargePlace Scotland network of public electric vehicle chargepoints. This support is set within a landscape where significant aspects of electric vehicle charging policy and all electricity network regulation is reserved to UK government.

This report highlights that Scotland is now at a tipping point, as a number of factors converge in the planning, delivering and financing of public electric vehicle charging infrastructure, namely:

- Both the scale and pace of investment in public electric vehicle charging infrastructure will need to be accelerated to meet growing demand over the coming years. It is unsustainable for the public sector to meet this challenge on its own.

- Whilst an important driver of early uptake, the provision of free to use public charge points, through the ChargePlace Scotland network needs to change; more sustainable financing models are required to remove barriers to private sector investment.

- The natural renewal cycle of electric vehicle charging infrastructure creates opportunities to set in place new ways to encourage commercial investment in the next generation of technologies.

- With increased uptake of electric vehicles, there will be an increasing need to address the different challenges of the various electric vehicle charging markets, and to establish appropriate planning and delivery approaches for each of them to maintain equitable access to electric vehicle charging across society.

- Building on Scotland’s collaborative approach to delivering electric vehicle charging, there is now an opportunity to bring together an even broader cross-section of the public sector – government, local authorities and regulators – as well as the private sector – car manufacturers, charging providers and electricity network owners and suppliers to harness efficiencies and opportunities, and add value to the economy.

In seeking to address these factors and informed by stakeholder engagement, this report identifies a number of areas for consideration, whilst also establishing a clearer vision of the longer-term requirements and needs:

- optimising the ability to leverage private investment, skills and resources to improve the planning, delivery operation and maintenance of electric vehicle charging infrastructure;

- encouraging the deployment of private capital through partnerships with the public sector, complementing and improving the existing public charging base for electric vehicles;

- ensuring that the strengths of the ChargePlace Scotland network are built on in a transition toward a commercial delivery model, recognising the need for access to chargepoints across the whole of Scotland, including both rural and urban areas;

- maintaining a consumer focused approach that ensures an integrated and reliable network of chargepoints that provides cost and equity of access to all user groups as part of a Just Transition to Net Zero;

- establishing guidance, tools and additional support to assist the public sector for the potential adoption of new financing and delivery models and sharing of learning across Scotland;

- the need for chargepoint hosts to review current pricing policies and electric vehicle charging tariffs to reduce public subsidy and, more importantly increase commercial viability of new charging investment, whilst maintaining inclusive access;

- assessing the options for the future role of ChargePlace Scotland within the wider delivery of electric vehicle charging infrastructure;

- learning lessons from innovative approaches already undertaken – such as the Project PACE partnership with SP Energy Networks and work on the Electric A9 with Scottish and Southern Energy Network; and

- continuing engagement with the Office of Gas and Electricity Markets (Ofgem) and industry to influence the regulatory environment to enable efficient investment in electricity networks to meet future public electric vehicle charging needs whilst protecting consumers.

Introduction

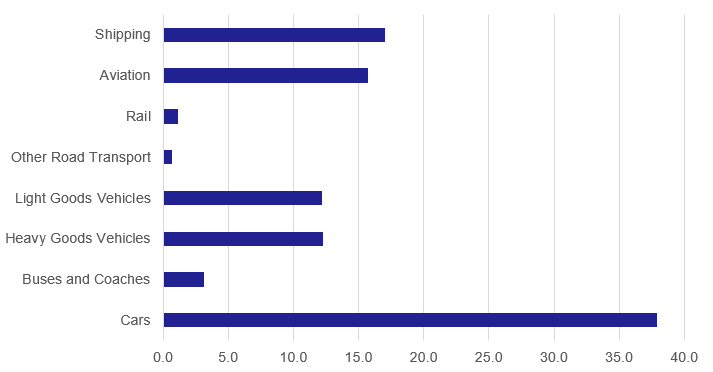

The Scottish Government has world-leading climate targets, setting legally-binding requirements to achieve a 75% reduction in greenhouse gas emissions by 2030 and to achieve Net Zero by 2045. The transport sector is currently the greatest contributor to emissions, emitting a total of 13.9 million tonnes of carbon dioxide equivalent in 2019, with road transport contributing the most (Figure 1). Supporting the uptake of electric vehicles is an important component of the Scottish Government’s Climate Change Plan; aligned with the outcome of phasing out the need for new petrol and diesel cars and vans by 2030 as well as removing petrol and diesel cars from the public sector fleet by 2025.

Figure 1. Percentage of transport greenhouse gas emissions by mode in Scotland, 2019 – Source: Scottish Greenhouse Gas statistics: 1990-2019

In seeking to encourage the uptake of electric vehicles, the provision of adequate infrastructure is vitally important. Anyone driving an electric vehicle, or considering the purchase of an electric vehicle, needs to have confidence that they can access chargepoints which are convenient and reliable, particularly if they have no access to home charging. The possibility of running out of charge is frequently cited as a recurring concern of electric vehicle drivers as is operational availability of chargepoints.

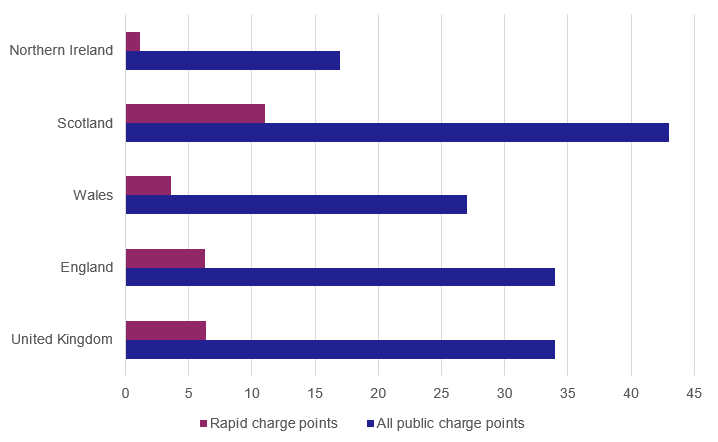

Recognising this, the Scottish Government has for several years supported the development of a national network of public electric vehicle chargepoints, investing in advance of need in order to provide the assurance that electric vehicle drivers require and building public awareness of the emerging electric vehicle market. The national brand, ChargePlace Scotland, has allowed drivers to charge their cars across Scotland, without having to carry multiple access cards. UK government analysis of data derived from Zap Map shows that investment in public electric vehicle infrastructure in Scotland, comprising ChargePlace Scotland as well as private chargepoint network operators, rates very well when compared to the rest of the UK both in terms of overall numbers of public chargepoints and rapid chargepoints (Figure 2).

Figure 2. Public electric vehicle charge point per 100,000 population by UK and region (April 2021) – Source: Electric vehicle charging device statistics: April 2021

To date, Scottish Government financial support has primarily taken the form of capital grants, distributed to all 32 of Scotland’s local authorities and other chargepoint hosts, who retain responsibility for procuring, commissioning, operating and maintaining the chargepoints, which are managed through the ChargePlace Scotland back-office system. To encourage utilisation, local authority chargepoints have offered a period of free charging, although a growing number have now either introduced, or are in the process of introducing, tariffs.

Looking ahead, the number of public chargepoints will need to increase rapidly to accommodate the number of electric vehicles which will be on the road. Capital investment requirements will increase accordingly, as will the demands placed on local authorities for the provision of adequately planned, maintained and operated public charging capacity. This has to be considered in the context of the rapidly evolving market for electric vehicles and provision of the associated infrastructure, with private chargepoint network operators investing capital, skills and resource in the sector, alongside public investment. Furthermore, this needs to sit within a landscape where significant aspects of electric vehicle policy and all electricity network regulation is reserved to UK government.

In considering the future direction of the financing and delivery of public electric vehicle charging infrastructure in Scotland, as set out in this document, the Scottish Futures Trust has worked with Transport Scotland in engaging extensively with the wider marketplace over the past 18 months. A large number of discussions have been held across the sector with private chargepoint operators, funders, electricity Distribution Network Operators (DNOs) and public bodies in both Scotland and England. Discussions focussed on opportunities for greater commercial investment and the factors driving that; the installation, commissioning, operation and maintenance of infrastructure; the availability of skills and resources; the formulation of electric vehicle strategies; business models; the role of the DNOs, and electric vehicle infrastructure integration.

Against this background, this report considers factors influencing the development of Scotland’s public electric vehicle charging infrastructure. It considers whether opportunities now exist to use the growth of consumer demand for electric vehicles to establish new models for financing and delivering infrastructure investment, without losing the benefits to consumers that comes from Scotland’s unique national charging network and doing so in a way which ensures that all communities across Scotland are able to benefit from a just transition to electric vehicles. It highlights opportunities for increased capital investment in the infrastructure necessary to support the rapid growth in uptake of electric vehicles in Scotland, sets out possible key roles the public sector can play in shaping and influencing investment and signals the short to medium term focus of the Scottish Government on leveraging private investment in Scotland through partnerships with local authorities.

Electric vehicles and charging infrastructure in Scotland – present and future

Electric vehicle numbers

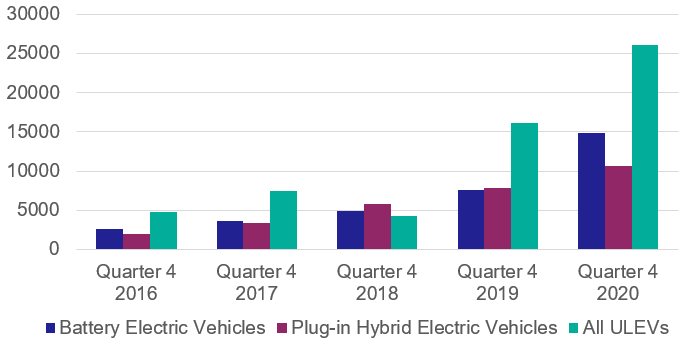

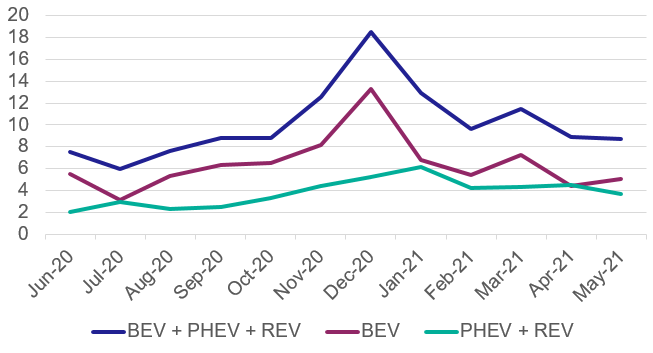

As of December 2020, over 26,000 licensed vehicles in Scotland were classed as Ultra Low Emission Vehicles or ULEVs, with the majority of these being either a pure Battery or Plug-in Hybrid Electric Vehicle (Figure 3). Latest data from the Society of Motor Manufacturers and Traders (SMMT) shows that over 12 months to May 2021, pure battery electric vehicles, plug-in hybrids and range extender vehicles made up on average 10.1% of all cars sales in Scotland. In December 2020, sales of these vehicles reached 18.5% of new car registrations, with pure battery electric vehicles contributing to 13.3% of this total (Figure 4).

The automotive industry is responding at pace to climate change targets and emerging markets and technologies, significant growth is expected in the number of new zero emission vehicles brought to market over the next few years, with corresponding increases in electric vehicle purchases by households and businesses. Responding to this growth in demand will be important but needs to be considered within the context of Scotland’s overall ambition for a much greater sustainable and inclusive travel and transport system as reflected in the Scottish Government’s National Transport Strategy which seeks to achieve greater levels of active travel and use of public transport and a reduction in the reliance on car use.

Figure 3. Number of Battery Electric Vehicles, Plug-in Hybrid Electric Vehicles and overall Ultra-Low Emission Vehicles registered in Scotland – Source: Department for Transport table VEH0132: Licensed ultra-low emission vehicles by local authority: United Kingdom

There are various factors which will influence the rate of uptake of electric vehicles. An important element will be the supply side, where the numbers of different electric vehicle types offered by the major car manufacturers is rapidly increasing. As of March 2021, there were 44 pure battery electric and a further 75 plug in hybrid models available in the UK, between them accounting for over 25% of available models; electric and hybrid electric vehicles accounted for 18.8% of vehicle production in the UK in 2020 (source: SMMT Blueprint for the Electric Revolution).

Further rapid growth in the number of plug-in electric vehicles over the next few years is to be expected as costs of vehicles come down and consumer confidence grows. This will of course necessitate the need for further significant investment in charging infrastructure, including public charge points.

Figure 4. SMMT data on % number of new car registrations that were Battery, Plug-in Hybrid and Range Extended Electric Vehicles in Scotland (June 2020 to May 2021)

Public electric vehicle charging infrastructure – current landscape

Electric vehicle charging typically takes place in a number of distinct domains – home, workplace, or in public. Public charging can take place at destinations, on-street facilities or en-route. It is reasonable to anticipate that the proportion of home charging will fall in Scotland as electric vehicles are more widely adopted, influenced by the uptake of vehicles by households who do not have access to off street parking and who lack the ability to charge at home. This emphasises the need for an expansion of public electric vehicle charging opportunities.

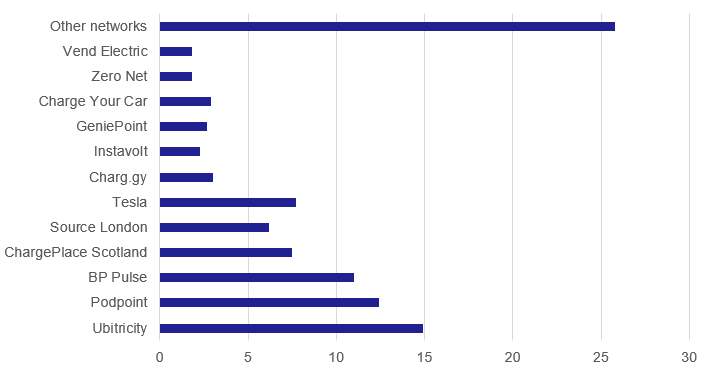

Data from Zap Map shows that, as of 28th June 2021, there were 2,558 public electric vehicle charging points in Scotland, representing 10.4% of the UK total. ChargePlace Scotland accounts for more than 1,800 of these and is by far the largest public network in Scotland and ranks fourth in the UK overall (Figure 5).

Figure 5. UK market share of public electric vehicle charge points by network as of 28 June 2021 – Source: Zap-Map Statistics

Alongside public investment there has been significant private sector investment in electric vehicle charging infrastructure in the UK. As well as homeowners installing domestic chargepoints, many destinations are doing likewise and there are a growing number of commercial operators establishing national rapid charging networks. The existence of public funded, tariff free electric vehicle charging provision does not incentivise private investment in public chargepoints in Scotland, particularly as the commercial case for many chargepoints will remain marginal in the short-term.

Future investment requirements in public electric vehicle charging infrastructure

Supporting the mass market growth in electric vehicles in Scotland will need to be accompanied by a major expansion in the number of public chargepoints. This needs to be undertaken in a fair, equitable and just way, accounting for both rural and urban Scotland, so that no parts of society are left behind. A ratio of one public chargepoint for every ten electric vehicles is sometimes quoted as a guide for provision (as per EU Directive 2014/94/EU). Given the rapid development of battery and charging technology it is difficult to target a specific ratio but clearly as electric vehicle numbers rise, public chargepoints will also have to multiply to keep pace with demand. The Climate Change Committee has, for example, estimated that c.280,000 public chargepoints will be required across the UK by 2030, implying a Scottish total of around 30,000 by that date (Table 1).

| Location | 2020 | 2030 | 2040 | 2050 |

| On street / local | 17 | 270 | 460 | 520 |

| Inter-urban | 0.5 | 8.5 | 10 | 10.5 |

| Total | 18 | 280 | 470 | 530 |

Table 1. Climate Change Committee, total UK public charging infrastructure in a balanced pathway in thousand units – Source: Climate Change Committee 6th Carbon Budget, Surface Transport (December 2020)

The cost of a chargepoint depends upon a number of factors, including its output power rating, location and costs of connecting to the electricity network. Charger technology is evolving rapidly and higher powered chargers (150kW +), which take less time to fully charge an electric vehicles, are now becoming more common with a number of private sector charge point networks installing these at sites in Scotland. Higher powered chargers are more likely to incur significant grid connection (and use) costs.

Capital costs of installing chargepoints can range from less than £5,000 (slow) to more than £40,000 (rapid). The number of chargers that will be required, the types of charger and the rate of deployment cannot be accurately predicted with any certainty. What can be said with certainty is that the numbers of installations will be a multiple of current levels, as will be the cost of capital investment total. If it is assumed that over 4,000 new public chargepoints could be required annually (as might be required to meet the Climate Change Committee numbers above) and there was an average cost (based on a mix of charging capacity) of £15,000 to £20,000, the annual investment may, in time, approach £100m. This need not be dominantly funded from the public purse. There is now an opportunity to work with delivery partners to identify the investment need across Scotland, optimise the mixture of public and private funding and secure value for money.

These estimates exclude the ongoing running costs as well as asset replacement (future proofing) and, importantly, do not include the estimated cost of grid upgrade works. The cost of upgrading the network to accommodate future demand from EVs and heat electrification is not insignificant. The Climate Change Committee estimates that, by 2030, annual investment of £5 billion will be required in the UK’s energy networks. This will largely be funded through consumer bills.

The energy regulator (Ofgem) runs a series of price controls known as RIIO to manage the level of returns to network business and protect current and future consumers from inefficient investment. Decisions made under the next set of regulatory price controls (RIIO2) will be critical for the Scottish 2030 interim targets as set out in the Climate Change Plan update. The Scottish Government, Ofgem and industry have developed and agreed a number of principles which set out the need to account for devolved policy and targets in regulatory decision making.

Higher power, ultrafast electric vehicle charge points, which are more expensive, come with the probability that they require more extensive grid upgrade work (but have the advantage of higher throughput of vehicles so proportionately fewer may be required). In addition, capital costs may fall as technology advances and other, complementary technologies are deployed in parallel (e.g. battery storage). A key question is who is best placed to respond to the investment needs of this emerging market and assume the implied technology risk (and benefit); the skill sets required are, generally, more associated with the private than the public sector although the latter may well still have a role to play in intervening to address any market failure.

The ChargePlace Scotland Network

At an early stage in its funding of public charging capability, the Scottish Government, via Transport Scotland, has aimed to provide electric vehicle drivers with confidence that they would be able to access public chargepoint on journeys across Scotland. Accordingly since 2013 the Scottish Government, has invested over £45m in the development and expansion of the ChargePlace Scotland Network, delivering over 1,800 public chargepoints. Scottish Ministers have also funded the ChargePlace Scotland back office that provides the centralised system for managing each chargepoint asset enabling them to operate under the ChargePlace Scotland brand. The contract to run the ChargePlace Scotland back office is in the course of transitioning from BP Pulse to Swarco Evolt. Investment in advance of need, the (initial) absence of tariffs and national coverage has helped to establish ChargePlace Scotland as the largest provider of public chargepoints across Scotland.

The principal funding programme for this early market intervention has been the Local Authority Investment Programme (LAIP), under which local authorities receive 100% capital grants towards the installation of chargepoints. Investment in the ChargePlace Scotland Network has also been facilitated through other Scottish Government initiatives, including those administered through the Energy Saving Trust, the European Regional Development Fund as well as the funds available through the UK Government’s Office for Zero Emission Vehicles.

Under LAIP, local authorities own the chargepoints and are responsible for locating suitable sites, procuring installation contractors, commissioning the asset, and operating and maintaining the chargepoints. But, if, as noted above as the requirement for public electric vehicle charging infrastructure grows, the current delivery model will place increased demands on local authorities given the need to develop and deliver electric vehicle charging strategies and integrating these into local energy planning. It also, however, provides opportunities for local authorities to consider how they wish to develop charging provision in their areas and, in order to maximise investment opportunities, whether they should do so in partnership with other local authorities and the private sector.

The ChargePlace Scotland back-office system monitors chargepoint availability, utilisation, reports faults to chargepoint “hosts” (the owners of the chargepoints) and facilitates payment (where tariffs are charged). There are over 400 hosts, comprising both local authorities and private sector entities which have benefitted from capital grants. The operator of the ChargePlace Scotland system also has operational oversight of chargepoints, through well-defined fault management processes, engaging with local authorities and other hosts to ensure chargepoints are fixed and available for use.

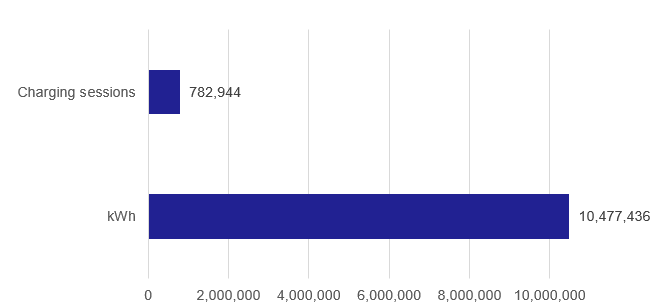

As noted, to incentivise the early uptake of electric vehicles, local authority hosts were initially obliged to offer free charging on Scottish Government funded chargepoints for a period of at least 12 months from the date of commissioning. ChargePlace Scotland chargepoints supported over 780,000 charging sessions in 2020 and in the process delivered over 10.47 million kWh of electricity in 2020, much of it free (Figure 6). Utilisation is rising rapidly and, where tariffs are not applied, the cost of free provision will also rise. And even where tariffs are introduced, simply covering the cost of electricity will not generate the funding required for asset management and replacement.

Figure 6. Number of charging sessions and kilo watt hours of electricity provided by the ChargePlace Scotland Network in 2020 – Source: Scottish Transport Statistics Number 39 (2020) table 13.12

A growing number of local authorities have adopted, or are planning to adopt, tariffs. There is no common approach across local authorities, which means that the cost to an electric vehicle driver of using the ChargePlace Scotland network will vary by local authority jurisdiction. This is not necessarily a barrier to electric vehicle drivers accessing charging opportunities and, importantly, drivers are typically clearly advised online and via signage what the tariff and charges will be. However it may lead to situations where drivers may be incentivised to drive to nearby charging locations across local authority boundaries to access cheaper charging.

The cost of charging (or refuelling an electric vehicle) has an important equity dimension. Those who are able to charge at home in driveways or garages enjoy both the most convenient and cheapest method of charging. A number of utility companies are now offering energy tariffs tailored specifically to electric vehicle owners, offering incentives to charge at off-peak times. Households without driveways, will be reliant on accessing public charging, which is currently often more expensive. Ensuring a just and fair transition means consideration needs to be given to ensuring all communities across Scotland can benefit from the switch to electric vehicles and to determining how future funding models can assist.

Emerging challenges and opportunities

Introduction

As highlighted above, electric vehicle charging can take place in a number of domains and there is an emerging acknowledgement that the non-home charging market characteristics are breaking down into a more granular basis: domestic off street; workplace destination; public sector destination; private leisure/retail destination; and en-route. The potential delivery and commercial models and incentives as well as demand take-up could be quite distinct and therefore what is currently defined as public infrastructure cannot necessarily be considered as a single market in the long term.

For now, demand for electric vehicle charging is developing rapidly, as is the demand for electric vehicles. Notwithstanding this, the levels of utilisation generally experienced at present mean that many chargepoint sites do not provide an immediate return on commercial investment. Many private operators are adopting a longer term perspective in assessing investment opportunities, however, and are evidencing their appetite to work in partnerships with public authorities.

Benefits of partnering with the private sector or mixed economy models

To date, Scottish Government funding has been instrumental in establishing Scotland’s national public charging network, ChargePlace Scotland, supported by Scotland’s 32 local authorities and other public and private sector hosts. If continued, however, this will be at an ever greater cost to the public purse. There will need to be significant investment in public electric vehicle infrastructure to support a growing and future mass market of electric vehicles in Scotland. But it will be impractical for the public sector alone to fund this investment. Additionally, the continued offer of tariff free access, will discourage other potential sources of investment and may both constrain growth of the network and lead to higher levels of public expenditure than is necessary to deliver a national charging network. If the current system of public funded provision of public charge points and free provision of electricity (even for a short period) is to be maintained this will be at a significant public cost.

Where it is possible to do so, private and public capital will need to be jointly deployed to support the roll out of charging infrastructure for all and increase investment totals. Developing these linkages and accessing the additional capital investment which it brings will considerably assist Scotland in boosting the numbers of public electric vehicle chargepoints. It will also allow public bodies access to additional skills and resources to assist with network planning, operations, maintenance and asset replacement.

In the future, rather than one funding model to support the provision of public charging infrastructure consideration will now need to be given to potential delivery models and how these could be developed, depending on the location and type of charging infrastructure required and the market being served.

Such models could include concession type arrangements between a public authority and a private operator whereby, for a defined period of time, the latter operates, maintains and expands the authority’s electric vehicle charging infrastructure and accepts revenue risk on chargepoint utilisation. Other models could include a landlord/tenant type relationship between the public authority and a private operator, longer term joint venture arrangements, or revenue based support models. To the extent such models could be introduced on a regional basis, or as local strategies set within a regional context, this could result in better network planning and delivery efficiencies.

The adoption of such models, with or without complementary public funding, offer enhanced opportunities to leverage private sector investment to boost the provision of public electric vehicle charging capacity. And adoption of these models may also bring other benefits alongside capital investment, primarily in bolstering the skills and resources available to the public sector in identifying the investment required in public electric vehicle chargepoints and planning the delivery of electric vehicle charging strategies and network operation.

For example, the current ChargePlace Scotland model places significant responsibilities on local authorities. They are responsible, inter alia, for ensuring that the chargepoints they own are adequately managed and fixed when faults occur. This is important as the ability to provide reliable and available electric vehicle charging is critical in ensuring consumer confidence. Partnership with the private sector offers the potential to introduce skilled and experienced resource to assist with efficient operations.

Tariffs

One of the factors influencing private sector operators’ willingness to invest will be the approach which is taken on tariffs. Although the number is diminishing, two-thirds of Scotland’s 32 local authorities have not implemented tariffs on their public chargepoints, with the cost of the electricity borne by the host. The existence of free provision does not incentivise commercial investment.

More widely, with regard to tariffs, the potential cost to the public purse of free provision has been noted. The absence of tariffs also distorts electric vehicle charging behaviour (e.g. electric vehicle drivers may have access to home charging but elect to use public infrastructure because it is free) and, in any case, it is not clear that the absence of tariffs exercises any significant influence on electric vehicle uptake. A non-tariff regime also means limited financial incentive to public authorities to ensure availability and reliability of chargepoints, as there is no revenue loss associated with unavailability.

Where tariffs are introduced, they should cover more than just the cost of the electricity supplied. The existing ChargePlace Scotland infrastructure has been built up over a period of years and will require investment against a background of rapid technological change. With a potential life of a chargepoint being up to 10 years, there will be a rising replacement cost placed on local authorities to simply retain the ChargePlace Scotland network at its existing size, even without accommodating technological advancement. The pricing models currently adopted by local authorities might not make adequate allowance for replacement costs or the cost of technology upgrades.

And, finally, while more local authorities are introducing tariffs, no common approach has been established, resulting in different tariff regimes, dependent on geography, within the ChargePlace Scotland network. It is important that tariffs reflect local needs, utilisation and delivery and maintenance costs. And for that reason hosts, whether local authorities or private sector, are best placed to determine the level at which tariffs are set. But there is the opportunity at this point to consider if greater partnership working across local authorities would deliver integrated approaches, and if commercial partnership and investment has the ability to bring greater efficiency to the delivery of this service.

The wider introduction of tariffs will represent a move towards the “user pays” model in contrast to the initial arrangements, where the costs of establishment and utilisation of local authority chargepoints was borne by all. Whilst arguably this has been desirable in the early adoption stage, this may not represent the fairest cost allocation in the longer term. ChargePlace Scotland chargepoints are taxpayer (capital grants) or council tax (free or subsidised electricity) funded. While accepting there is likely to be a role for public funding in supporting provision of chargepoints, which might otherwise be commercially unviable, the question of whether all taxpayers (non-drivers included) should support car transport (no matter how green it is) is debatable. Drivers are accustomed to having to pay a commercial price to fuel their petrol or diesel vehicles at present and, in principle, should be prepared to do the same for an electric vehicle.

Interoperability

The ChargePlace Scotland network provides electric vehicle drivers in Scotland access to a national network with one card. Drivers therefore had less need to carry multiple cards in order to be comfortable of chargepoint access.

The market is, however, moving on. Pay-as-you-go access, once very limited, is now becoming much more common, as are smartphone apps. Currently, new rapid charge points being installed on the ChargePlace Scotland Network will also provide facilities for contactless payment and a retrofit programme of existing chargers is also a Scottish Government priority. Interoperability across networks is also gaining some traction. Seamless user access of chargepoints is fundamental in providing electric vehicle drivers with a good experience and encouraging public acceptance. The UK Government has recently consulted on interoperability as part of its wider consumer experience work and may introduce future regulations to facilitate this. Catering for the distinct needs between different users (e.g. members of the public and fleets) will need to be factored in to optimise the approach.

Electricity Distribution Network Operators

An important determinant of the overall cost of installation of electric vehicle chargepoints relates to the work carried out by the electricity Distribution Network Owners (DNOs) in providing grid connection . This can often lead to significant costs, particularly for higher powered charging points and the process of obtaining and confirming quotes can lengthen the installation timetable. Combined, these factors can make it difficult for chargepoint developers to plan, select locations, and successfully manage budgets/costs. Taking a coordinated approach to the planning and delivery of electric vehicle charging and electricity infrastructure will be vital going forward. This will reduce development costs and unnecessary investment and thus protect consumers.

Project PACE, for example, is a £5.3m demonstrator project that has been coordinated as part of the Strategic Partnership between the Scottish Government and Scotland’s electricity DNOs. This project, delivered across Lanarkshire by SP Energy Networks, has sought to evidence the benefits and efficiencies of a DNO-led approach to the planning and delivery of public electric vehicle charging infrastructure. Early outputs of this project have indicated the potential for significant cost savings of between £1.3m to £2.6m in electricity grid connection costs through optimised site selection across 44 electric vehicle charging hub sites in the project area.

DNOs will play a key role in enabling the realisation of Scotland’s net zero targets, in delivering both decarbonisation of heat and of transport. The pace and overall cost of electric vehicle chargepoint roll out will be determined by the ability of the DNOs to respond to the demands for charging infrastructure, whether it be home, workplace, destination or public. At present DNOs are constrained from investing in advance of need. If this remains the position this may act as a brake on development, with DNOs reacting rather than anticipating demand. There are opportunities for this to improve however through a number of ongoing regulatory reforms.

Through the recently published energy network principles the Scottish Government has committed to work with Ofgem and Industry to help develop well-justified network investments which anticipate and respond to the needs of Scottish energy policies, ambitions and targets.

Ofgem’s recent announcement of £40 – 50 million of “Green Recovery” funding being awarded to energy network projects across Scotland, is the product of an agile approach to investment. This must be built on to ensure that networks remain capable of supporting Scotland’s net-zero transition in the next RIIO price control period.

Wider issues

As well as its impact on electricity grids, electric vehicle charging provision has implications for other areas of infrastructure establishment, including digital connectivity. Accessing chargepoints depends upon adequate communication linkages. It is necessary to continue to consider the coverage required to enable the “smartest”, most efficient use of energy networks and related charging mechanisms. This will be important particularly in terms of ensuring access to chargepoints across Scotland, include rural and remote areas.

Conclusions

This report is informed by an extensive period of engagement with the public and private sector to consider the current state of play of public electric vehicle charging in Scotland, which has sought to identify challenges and opportunities and consider how best to respond to a rapidly developing market. It has set out a series of observations on steps that will need to be taken in order that households and businesses in Scotland can confidently make the switch to electric vehicles in the knowledge that the chargepoint infrastructure to support that will be available.

While recognising that in most cases, manufacturers are typically targeting electric vehicles at premium markets first, it is imperative that access to, and the costs of, electric vehicle charging works for the whole of Scotland and all consumers as part of the just transition to Net Zero. While significant aspects of electric vehicle charging policy and all electricity network regulation is reserved to the UK government, future policy and delivery in Scotland should maintain a focus on issues such as cost and access to chargers for those without off-street parking, ensuring early generation technologies are still supported as new technologies are adopted, and ensuring continued investment across all parts of Scotland, including in rural areas.

Working closely with technology suppliers, supply chains, retailers, leisure and hospitality sectors as well as business at large and the public, may help to ensure that policies, plans and investments capitalise on the widest breadth of economic opportunities. This will also be critical in responding to consumer needs, and support business through the transition from fossil fuels.

Technologies will also continue to develop at pace, and further disruptive innovation in the future can be expected, whether that be in battery or fuel technology, the provision of charging, or wider advances in digitally enabled mobility and business models. Throughout this period, it will be important to maintain a focus on the consumer experience, and make electric vehicle ownership as intuitive as possible. Initiatives such as those on improving the design of electric vehicle chargepoints to make them more accessible to all, will become increasingly important, and provide opportunities to industry in a competitive market place to innovate and in doing so further enhance consumer experience.

In conclusion, this report highlights that:

- Demand for electric vehicles and associated charging will increase significantly in Scotland over the next decade in response to changing government policies and market developments. How Scotland responds to this will be key in ensuring that drivers in Scotland can confidently switch to electric vehicles and use them.

- Funding of public electric vehicle charging in Scotland going forward will need to reflect these developments and will need to transition away from the current ChargePlace Scotland model towards one which leverages private capital and skills.

- Local authorities and other public bodies should be encouraged to leverage in private capital to lessen the cost to the public purse of further expansion of the public electric vehicle charging network. There are a number of well capitalised private chargepoint operators willing to invest in public charging infrastructure. Private operators will also bring chargepoint planning, operations and maintenance expertise to supplement local authority resources and assist with the development of electric vehicle policies and strategies.

- Mixed economy models, where the private sector works in partnership with public authorities, represent an opportunity to introduce these skills (and capital). For example, a private operator could assume responsibility for the installation, commission, operation and maintenance of charge points within a local authority area for a defined period of time, with the private partner providing some of the funding which would otherwise have to be provided through public funding. Such models could mitigate (or remove) revenue/cost risk from the authority and can introduce professional management to site selection and maintenance, both areas where stretched local authorities may lack resources and expertise.

- Existing ChargePlace Scotland assets which are owned by local authorities could potentially form part of any partnering arrangement. This might allow value to be realised from the initial public investment in chargepoints, increase the overall level of investment in new infrastructure and ensure that all chargepoint assets within a local authority area are under the same operational and tariff regime.

- The absence of tariffs or, potentially, the adoption of non-commercial tariffs for electric vehicle charging by local authorities may act to discourage private sector investment in public charging infrastructure in Scotland. Local authorities will need to consider, and be supported to adopt new policies.

- The area of greatest cost, and hence of greatest impact on business cases, particularly for rapid and ultra-rapid chargepoints, is DNO costs. As demonstrated by Project PACE, however, the early involvement of DNOs in chargepoint planning can bring significant cost and timing benefits. DNOs will be a key part of rolling out electric vehicle charging infrastructure and the ability of the wider regulatory environment to enable DNOs to make anticipatory investment remains a key issue for Ofgem to consider.

- Public sector transport decarbonisation is proceeding in parallel with the expansion of public charging infrastructure. Public sector charging infrastructure may also be capable of being made available to other user groups at times when the public sector vehicles are not using it. There may be instances where synergies can be realised and by doing so make a significant contribution both to the costs of establishing the public sector body’s charging infrastructure and to expanding the range of charging facilities available to the general public. There may be opportunities for local authorities to plan their own fleet charging requirements to ensure that public access is available to their “in-house” chargers, to the extent allowed by operational factors.

- If initiatives with private operators are taken forward, and their back office management systems introduced, there is the potential to erode the positive aspects of the existing ChargePlace Scotland provision. Because of pay-as-you-go, smart apps and roaming agreements, this need not impact on the electric vehicle driver’s experience. But consideration will need to be given to make sure that the best elements of the existing ChargePlace Scotland model are retained.

- Any future funding arrangements must ensure that all communities in Scotland are able to benefit from the switch to electric vehicles and support a just transition to net zero, which is likely to require longer term government support or intervention to address unsustainable commercial markets.

- Chargepoint access, payment and reporting systems are reliant on good communication systems. To ensure that national chargepoint coverage is attained, and access to chargepoints is available to all, the investment in charging infrastructure will likely need to be considered alongside investment in digital infrastructure, especially, but not exclusively, for rural Scotland.