World

Navigating Scotland’s energy transition: The imperative of sustaining oil and gas investments

The oil and gas sector has long been a cornerstone of Scotland’s economy, contributing significantly to regional development, employment and economic stability.

In 2022, for example, the sector contributed about £25.2 billion in gross value added (GVA) to the Scottish economy, representing about 11.8% of Scotland’s total gross domestic product (GDP).

However, in recent years, capital investments within the UK Continental Shelf (UKCS), of which Scotland is a major component, have significantly declined. As illustrated in the figure below, investments have plummeted from a peak of £16.20 billion in 2014 to £5.22 billion in 2023, representing a 67.78% drop.

The decline in capital investments can be partly attributed to the maturity of the UKCS basin.

Having been extensively developed and exploited for decades, the basin now offers limited opportunities for high-impact offshore exploration and extraction activities.

Additionally, over 180 of the currently producing 283 fields are expected to cease production by 2030.

North Sea ‘quadruple whammy’

Recent challenges have compounded these issues, with a quadruple-whammy of threats which are set to contribute to a further decline in capital investments in the basin over the coming years.

First, the aftermath of the global COVID-19 pandemic continues to dampen the sentiment for investment in the sector.

Second, persistent low and volatile oil and gas prices undermine financial stability and discourage capital allocation.

Third, there is a growing shift towards investments in renewable energy sources such as offshore wind, carbon capture, utilisation and storage (CCUS), and hydrogen production.

Between 2024 and 2030 for example, capital investments in offshore wind are projected to grow from £8.2 billion to £14.9 billion, an increase of approximately 82.45%.

In contrast, capital investments in oil and gas are expected to decrease from £4.8 billion in 2024 to only £2 billion in 2030, a decline of about 58.33% (see Figure 1). By 2030, renewable energy expenditure will account for 74% of the total offshore energy expenditure in the UKCS.

Fourth, the introduction of the energy profits levy (windfall tax) has raised the headline tax rate on the oil and gas sector in Scotland and the rest of the UK from approximately 40% to 75%, causing industry backlash and investment hesitancy.

Offshore Energies UK (OEUK) warns that the tax would “damage competitiveness and discourage energy companies from investing in the UK”. A survey indicated that 95% of OEUK members felt negatively impacted by the tax and are contemplating investments elsewhere.

Bleak North Sea investment outlook

These factors are set to contribute to a bleak investment outlook for the oil and gas sector in Scotland and the rest of the UK over the course of this decade and beyond, extending a trend of declining investments observed in the sector over the previous decade.

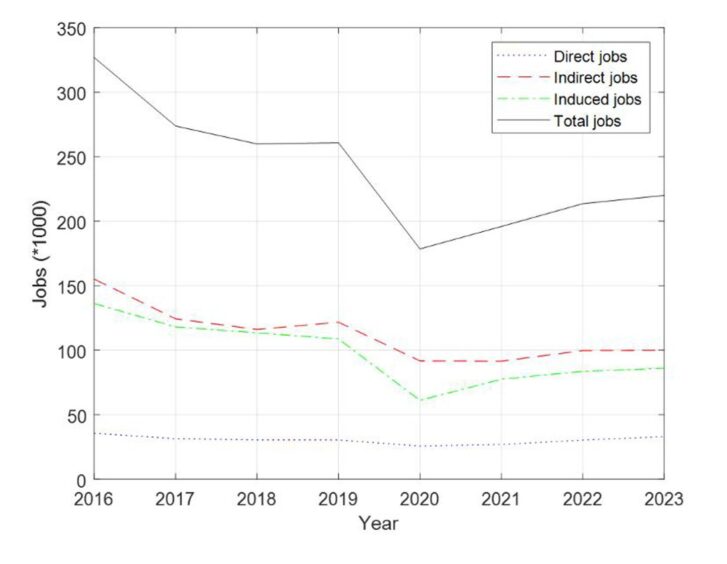

The reduction in capital investments has contributed to a corresponding decline in employment within the sector over the past decade, as shown in Figure 2.

In 2016, the UK oil and gas sector supported approximately 326,900 jobs, categorised into 35,600 direct, 155,100 indirect and 136,200 induced jobs.

By 2023, the sector saw a significant decline, supporting 106,000 fewer jobs than in 2016, with total employment dropping to around 220,000.

This contraction has affected not only direct oil and gas operations but also the extensive supply chain and broader economic activities linked to the sector across Scotland and the rest of the UK.

Scotland, in particular, plays a critical role, accounting for more than 80% of the entire UK direct oil and gas jobs, highlighting its dominance, strategic importance and vital contribution to the wider UK oil and gas industry.

Scotland set to lose 19,000 jobs by 2030

In my most recent study, I utilised a computable general equilibrium (CGE) model to examine the employment, economic and energy transition implications of under-investment in Scotland’s oil and gas sector.

Under current forecasts of declining upstream investments through the end of this decade, the study finds substantial job losses across multiple sectors, with a projected total loss of about 19,509 jobs in Scotland by 2030.

This includes 11,193 direct oil and gas sector jobs, with the sector expected to experience the fastest annual decline, losing about 1,865 jobs each year.

Other affected sectors include manufacturing, construction, finance and insurance activities, and wholesale and retail trade.

Adverse shifts in key macroeconomic indicators include a 2.11% decrease in GDP, a 0.37% increase in inflation and declines in government income, capital formation and household consumption budgets.

These findings have important implications for an emerging renewable energy sector within the context of the broader energy transition in Scotland.

Research shows that 90% of oil and gas roles have high or medium transferability to renewable energy roles, making the skills and experience of oil and gas workers critical for the successful development of Scotland’s growing renewables industry.

The oil and gas sector has over 50 years of operational experience in the energy space, including offshore operations, which is relevant to offshore renewables such as wind, hydrogen and CCUS.

This makes the connection between the oil and gas sector and the renewables sector in terms of employment expertise significant.

Mitigating oil and gas decline

Policy implications are clear: mitigating the decline in oil and gas investment levels slows job losses and facilitates an orderly transition of sector expertise to Scotland’s burgeoning renewables sector.

As the energy mix evolves and demand from low-carbon sectors increases, opportunities for workers in the oil and gas industry to transfer their skills will also grow.

However, a rapid decline in oil and gas investments risks a sudden, disruptive loss of jobs, leaving displaced workers with limited immediate opportunities as the renewables sector gradually develops.

This could result in a long-term loss of vital expertise necessary for the emerging renewables sector, thereby hindering the energy transition.

Sustaining investments in the oil and gas sector also enhances Scotland’s energy security by ensuring a stable supply of domestic energy resources.

Continued investments can drive technological advancements that make oil and gas extraction and processing more efficient and environmentally friendly, aligning with the UK government’s ‘maximising economic recovery’ policy.

Smooth, inclusive and just transition

Overall, mitigating the decline in oil and gas investments supports the energy transition, enhances energy security, fosters technological innovation and maintains the competitiveness of Scotland and the wider UK in the global energy landscape.

It also ensures a smooth, inclusive and just transition in Scotland.

While the decline in oil and gas investments poses significant challenges, it also presents an opportunity for a well-managed transition to a renewable energy future.

By sustaining investments and leveraging the existing expertise within the oil and gas sector, Scotland can ensure a smooth, just and economically stable transition that supports both current employment and future energy needs.

Policymakers must recognise the critical role of sustained investments in this transition and adopt balanced approaches that support both renewable energy development and the continued viability of the oil and gas sector.

Dr Yakubu Abdul-Salam is a senior lecturer (associate professor) in economics and finance at the University of Aberdeen, and the convener of the Aberdeen Centre for Research in Energy Economics and Finance

Recommended for you

Is anxiety a health issue? Worrying about the renewables supply chain

© SYSTEM

© SYSTEM © Supplied by CNOOC

© Supplied by CNOOC © Supplied by University of Aberdeen

© Supplied by University of Aberdeen © Wullie Marr/ DCT

© Wullie Marr/ DCT © Supplied by Wullie Marr/ DCT

© Supplied by Wullie Marr/ DCT