Sports

Should You Hold or Sell FICO After Its Impressive Run?

Traced back to 2022, Fair Isaac Corporation (NYSE:FICO)’s stock price has creeped from $400s in 2022 to almost $2000 in 2024. And predicted there will be more firing after the rate cut.

What is this company really about?

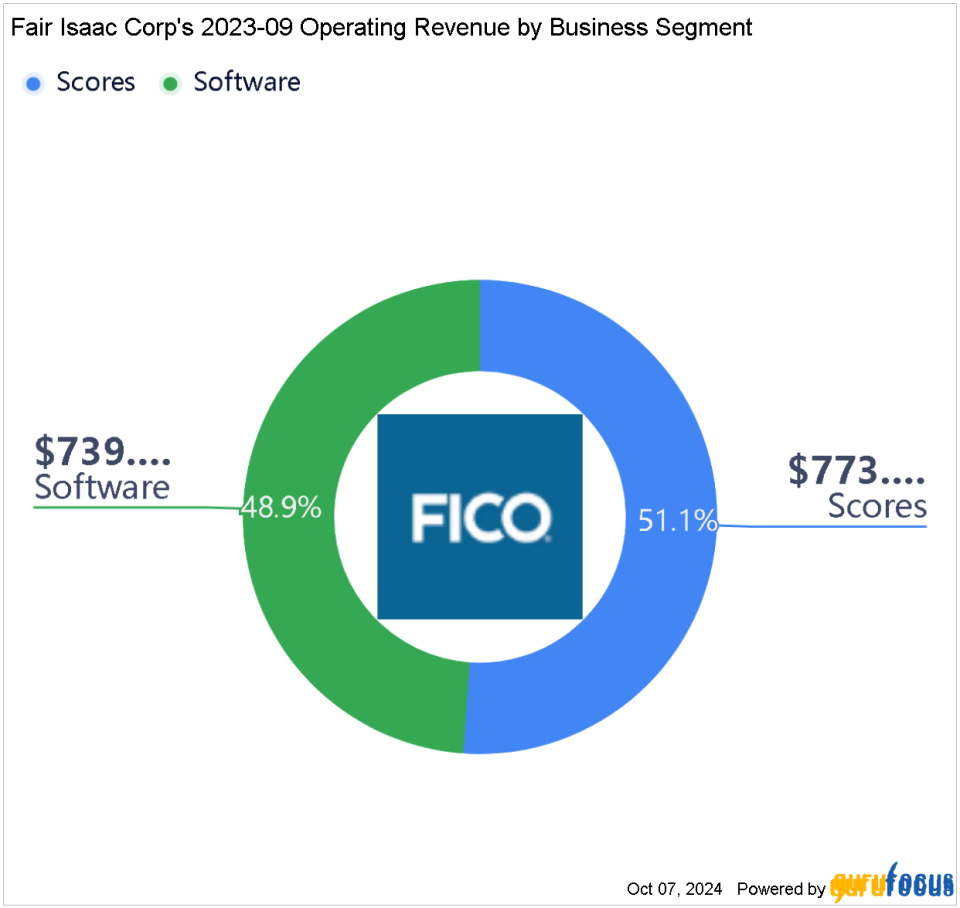

Fair Isaac Corporation is a predictive analytics and decision management software company that has two contributing segments: Scores and Software as simply depicted by GuruFocus below:

Scores here refer to the services and solutions made by FICO to help their clients to predict credit and other scores on millions of customers. Most recent updates are the FICO Score 8 and FICO Score 9. Experian, Equifax (NYSE:EFX) and TransUnion (NYSE:TRU) are three credit bureaus that account for over 40% of its total revenues. So, anyone who applies for a loan from these agencies in the US and some other countries will have his/her credit score checked using FICO’s credit score checker.

While the software segment is the FICO platform, a modular software to address problems such as account origination, customer management, account management and fraud detection, onboarding and pricing.

And now the Federal Reserve decided to cut interest rates at its September meeting, which is the first interest rate reduction since early 2020, by 50 basis points. This certainly creates a premise that FICO, as a credit-score provider, will get more benefits from this cut.

The demand for credit is typically higher when interest rates are lower, because of cheaper borrowing costs: Lower interest rates make your loan cost more affordable and encourage you and businesses to take on loans for various purposes such as buying properties, funding businesses and many more. And that’s why the hope for FICO is inflating.

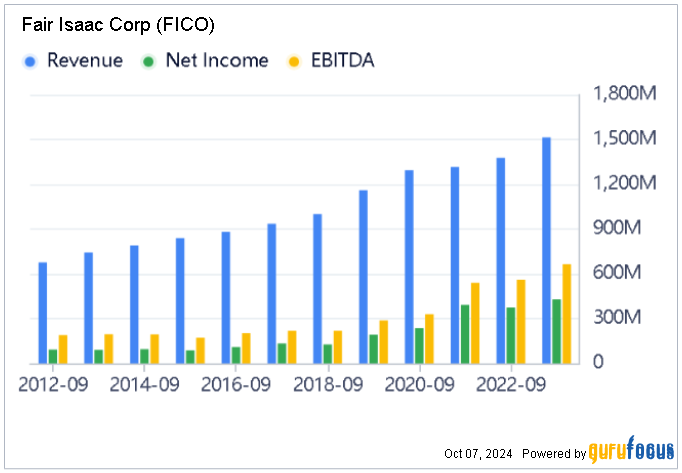

That’s one story for its expected revenue. And one of the reasons for the soaring stock Fico is that it reflects its impressive revenue and profitability:

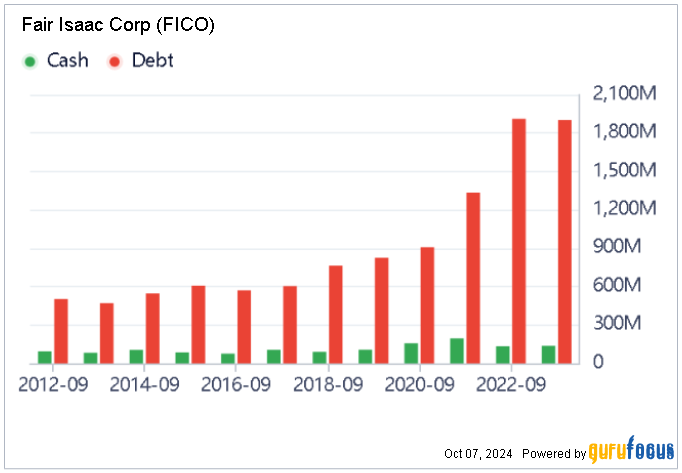

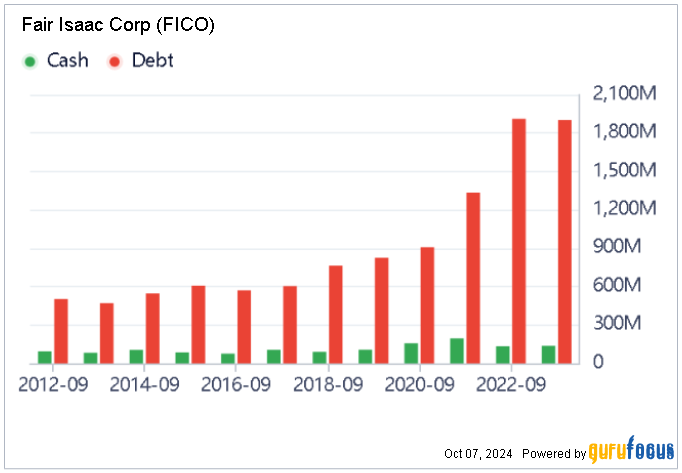

FICO’s annual revenue and profits has indeed been on a gradual upward trend in the past few years, but one should see broader than that. Because financial health should come under your supervision too when it comes to long term investment. Below is a ready-made cash vs debt position graph in the last 12 years.

While FICO’s profitability has been on a positive trajectory, there are still concerns about its overall financial health with towering debt compared to its cash.

You may want to see if FICO has set to be overvalued as it is traded at a forward GAAP price to earnings ratio of 94. But FICO’s role in the financial services industry is not easy to disrupt in anytime sooner as this industry require a huge barrier entry.

Don’t just read the latest news – You can make more informed investment decisions. Visit GuruFocus today and dive deeper into Fair Isaac‘s performance with Charts & Guru Insights.

This article first appeared on GuruFocus.