Sports

Warren Buffett Reduces Stake in Bank of America

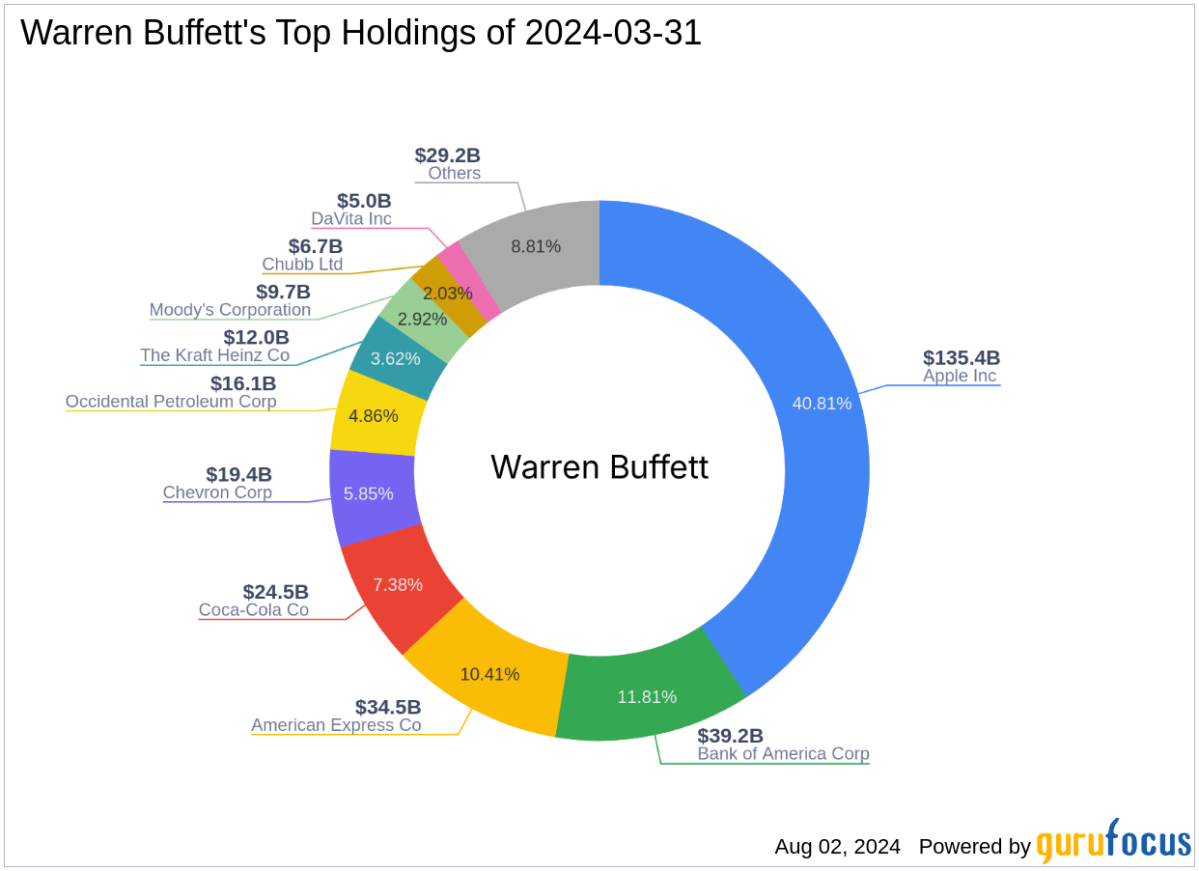

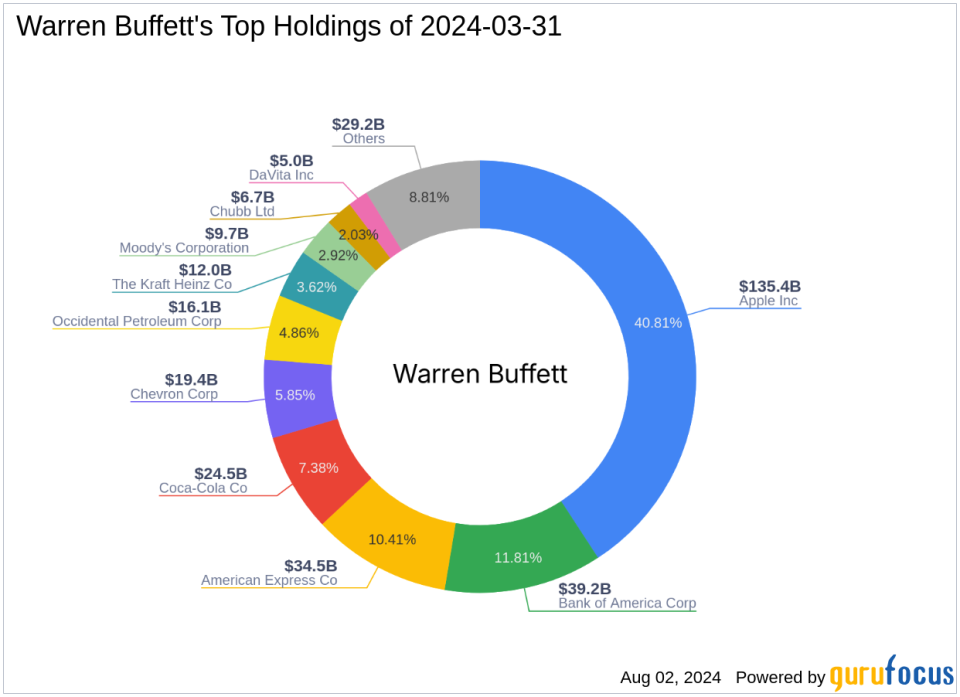

On August 1, 2024, Warren Buffett (Trades, Portfolio)’s firm made a significant adjustment to its investment portfolio by reducing its stake in Bank of America Corp (NYSE:BAC). This transaction involved the sale of 19,216,833 shares at a price of $40.52 each. Following this sale, the firm still holds a substantial number of shares totaling 942,429,882, representing an 11.54% position in its portfolio, down from 12.15%.

Warren Buffett (Trades, Portfolio): Investment Titan

Warren Buffett (Trades, Portfolio), often referred to as “The Oracle of Omaha,” is a towering figure in the investment world. As the chairman of Berkshire Hathaway, Buffett has transformed a modest textile company into a major conglomerate, primarily focusing on insurance and other diverse investments. Buffett’s investment philosophy, deeply rooted in Benjamin Graham’s principles of value investing, emphasizes understanding a business deeply, investing with a margin of safety, and choosing companies with long-term potential.

Bank of America at a Glance

Bank of America, symbol BAC, is a leading financial institution in the United States, boasting over $3.0 trillion in assets. It operates across several segments including consumer banking, global wealth and investment management, and global markets. The company, primarily focused on the U.S. market, has shown robust growth and profitability metrics, with a current market capitalization of $306.5 billion and a PE ratio of 13.91, indicating its substantial scale and scope within the banking industry.

Impact of Buffett’s Trade on His Portfolio

The recent transaction marks a slight reduction in Buffett’s exposure to the financial services sector, where Bank of America has been a significant holding. This move could signal a strategic shift or rebalancing of Berkshire Hathaway’s vast portfolio, which remains heavily invested in major corporations across various sectors, including technology and financial services.

Strategic Implications of the Sale

While the specific reasons behind Buffett’s decision to trim his position in Bank of America are not publicly known, it could be related to taking profits, portfolio rebalancing, or a strategic shift based on market outlook or valuation concerns. The sale has reduced Berkshire Hathaway’s stake in the company but still leaves it as a major shareholder.

Bank of America’s Market and Financial Standing

Currently, Bank of America is deemed “Fairly Valued” with a GF Value of $38.38, closely aligning with its current stock price of $39.5. The stock has experienced a year-to-date increase of 17.32%, reflecting positive market sentiment. Despite this, the recent sale by Buffett could influence market perceptions, potentially leading to short-term volatility in BAC’s stock price.

Broader Market Context

The financial services sector continues to be a significant component of the global economy, with companies like Bank of America playing pivotal roles. The sector’s performance is often seen as a bellwether for broader economic conditions, and investment moves by high-profile investors like Buffett are closely monitored for insights into their views on the market’s future direction.

Concluding Thoughts

Warren Buffett (Trades, Portfolio)’s recent reduction in his stake in Bank of America is a notable development, given his influence and the size of the transaction. While the immediate impact on BAC’s stock is uncertain, the long-term implications for Buffett’s investment strategy and the financial sector are of keen interest to investors and market watchers alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.